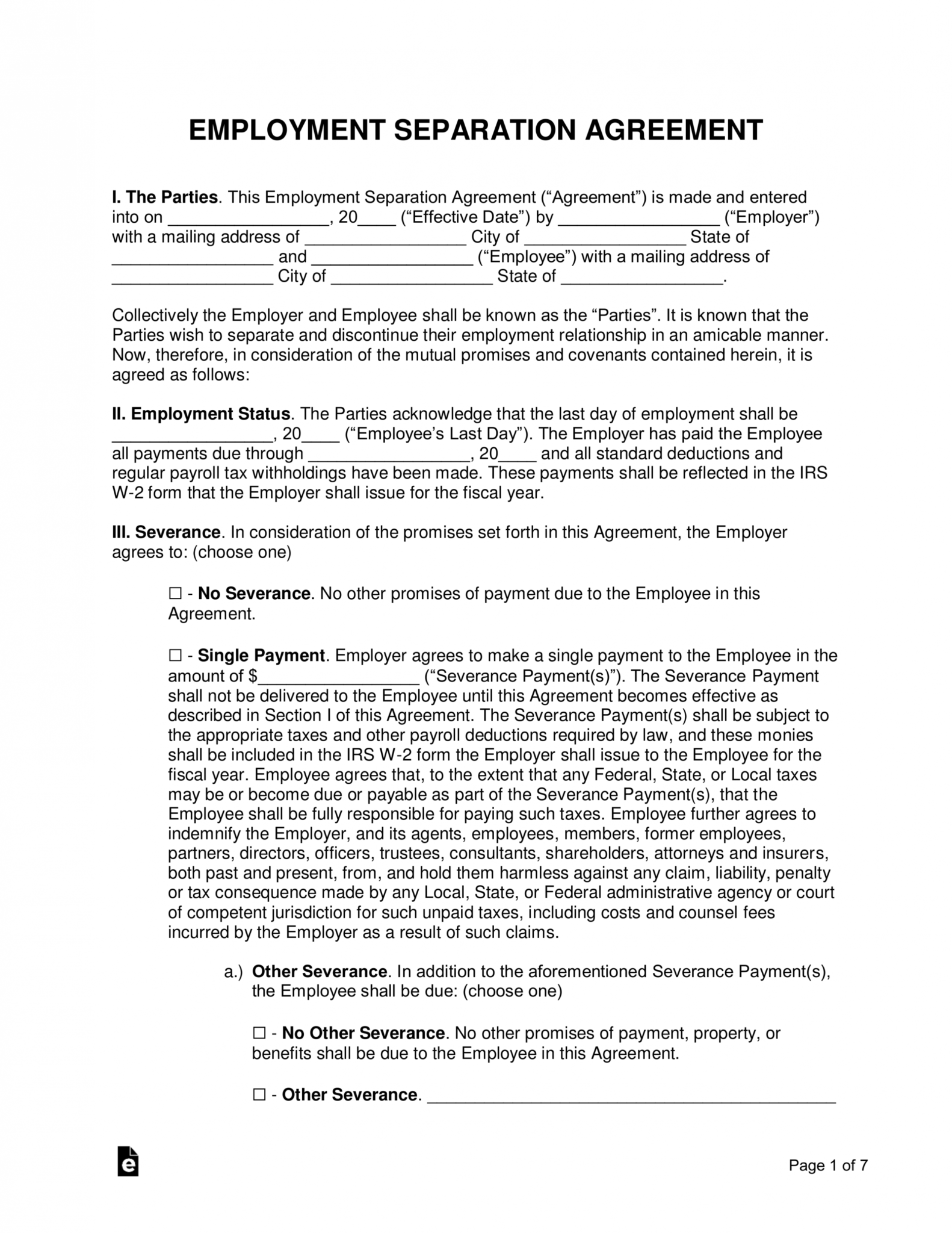

Finance Servicer Violations in Debt Changes. Home loan transaction parties

As soon as a homeowner can be applied for home financing loan modification, his or her application might be covered by a home mortgage servicer. It’s common for servicers to generate really serious failure while they are operating loan mod apps, triggering people become denied for any adjustments or even to generally be wrongfully foreclosed upon. There are particular factors property owners does any time financial servicers violate the principles with regards to finance modifications.

Loan transaction couples

To be able to understand the usual violations that happen within your mortgage loan taking care of discipline, it is important to basic are aware of the various person who are taking part in home mortgage transaction.

1. Mortgagor: any person who’s going to be borrowing the money, pledging his or her residence as safety your loan.

2. Mortgagee: the financial institution whom provides the debt on the mortgagor.

3. home loan broker: an event that investments mortgages from financial institutions, giving the loan providers with income they are able to used to offer way more debts.

4. Mortgage servicer: a business enterprise that handles finance profile from the mortgagee or mortgage investor’s part. Finance servicers manage money records on the part of the mortgagee or entrepreneur. The servicer is typically in charge of the annotated following:

- Giving the every month finance report towards home owner

- Handling expenses

- Monitoring levels amounts

- Controlling escrow accounts

- Evaluating applications for loan alterations

- Initiating property foreclosure process whenever the mortgagor loan defaults

Financing Variations

Money adjustments become permanent updates within the terms of the lending if you wish to bring down the monthly installments, deciding to make the money more affordable. Lenders may agree to any of these in a home loan version:

- Cut the interest rate

- Lower the total amount on the main

- Change the rate of interest from variable to remedied

- Expand along the real estate loan

Popular Mortgage Servicer Infractions in Money Alterations

There are various popular errors that servicers build inside loan mod procedure.

1. Perhaps not processing the required forms on time

It is not uncommon for everyone to perceive very long hold ups while they’re waiting for the servicer to determine regardless of whether a modification must certanly be given. Occasionally, servicers are not able to inform everyone they need to get missing information so as to make the company’s judgements. In other situations, servicers only don’t look at the software in due time.

Federal mortgage loan service rules that plummeted into impact on Jan. 10, 2014 are meant to reduce steadily the setbacks. Under these regulations, loan servicers whom see loan modification solutions from people 45 days or longer before property foreclosure sales must look at the adjustment software, see whether the applying is actually imperfect or total and alert the borrower within 5 period to allow for these people know very well what more information is desirable or if perhaps the required forms is complete. Servicers who acquire total services more than 37 weeks well before appointed foreclosures business must compare these people and discover perhaps the borrower qualifies within 30 days.

2. informing residence people must certanly be in default to be eligible for a modification

Even though it was once correct that home owners had to be belated using their repayments before being approved for changes, that is definitely will no longer accurate. As an example, folks may are eligible for your home low-cost changes Application when they are about on their charges or perhaps in threat of decreasing at the rear of in it.

3. demanding people to resend information

Servicers often inquire residence to resend info multiple times, especially with revenue verification. Servicers additionally just lose documents allowing it to talk to consumers to deliver these people once again. Customers should resend the content that is definitely asked for, but they should tape-record the date these people deliver it and exactly who it really is sent to. It is advisable to deliver critical information via a mode which quickly monitored, instance qualified send with repay bills of faxes with confirmations.

4. looking for initial payment

Most the effort, everyone shouldn’t be essential generate initial payment to qualify for money corrections. Your house Competitively Priced version regimen, or HAMP, doesn’t have a down pay criteria.

5. running the NPV with inaccurate money data

When loan mod software include examined, the servicer analysis economic facts the finance, the property or house as well as the borrower. Then, the servicer compares the bucks stream the investor will receive through an adjustment versus a foreclosure. If your entrepreneur will be in a rankings when the servicer forecloses, next the servicer is not needed to modify the loan. This is whats called the NPV calculations. In the guidelines, servicers have to inform the homeowners on the principles they utilized once estimating the NPVs. In case employed erroneous critical information, the rejection are appealed. Under HAMP, applicants bring a month to mend NPV values being inaccurate. The servicers must then look at the reports once again.

6. incorporating waivers in the loan mod forms

Servicers occasionally integrate waivers in loan mod arrangements that claim to waive all appropriate boasts the home owners might resistant to the servicer or mortgagee. HAMP forbids servicers from training loan modification approvals on relinquishing legal rights.

7. Definitely not converting trial improvements into long lasting personal loans

More finance improvements commence with a three-month demo course. Providing people generate timely charges during that demo cycle, the mortgage alteration connected converted into a long-lasting loan modification. Servicers often neglect to change trial intervals into long-lasting changes.

8. service transfers during an adjustment

Inside mortgage markets, it is not uncommon for servicing transactions to take place. The brand new servicer may then are not able to stick to the adjustment agreement which was set up using past one. Mortgage maintaining regulation require which  former servicers deliver new ones all of the info on loan mod conversations and any arrangements which were manufactured. The servicer should be certain they pursue mortgage loan modification contracts being already prepared.

former servicers deliver new ones all of the info on loan mod conversations and any arrangements which were manufactured. The servicer should be certain they pursue mortgage loan modification contracts being already prepared.

Communications an attorney at law

If a home mortgage servicer has actually dedicated all of these violations, it could possibly provide you have risen costs and prices to prevent a foreclosure. You may also finish up losing your own discounts while looking to get a loan change, become wrongfully foreclosed upon or lose out on more home foreclosure choices. You’ll be able to set up a totally free discussion by calling 1-866-96-GMLAW to understand more about your very own legal rights.