Organization backed by Montel Williams face crackdown

Montel Williams, an old daytime talk-show servers, possess wanted to withdraw their endorsement from MoneyMutual’s payday loan to The fresh Yorkers. (Photo: Jeff Katz, Showtime)

An early brand of that it story incorrectly known MoneyMutual once the a great lender. MoneyMutual connects loan providers with customers.

A new york banking regulator to the Monday blasted mortgage finder MoneyMutual to own covering up trailing their star endorser, Montel Williams, for the wrongfully product sales financing with heavens-large rates – some surpassing step 1,000% – so you can troubled The newest Yorkers.

Benjamin Lawsky, superintendent of the latest York’s Section out-of Financial Characteristics, said MoneyMutual, a good unit regarding business company SellingSource, features agreed to shell out an effective $2.one million punishment and you can quit the cash advance to generate leads situations regarding the Empire Condition, in which including loans try unlawful.

Williams, a former date-time speak reveal host, even offers wanted to withdraw his acceptance having paydays by way of MoneyMutual to Ny customers, Lawsky told you.

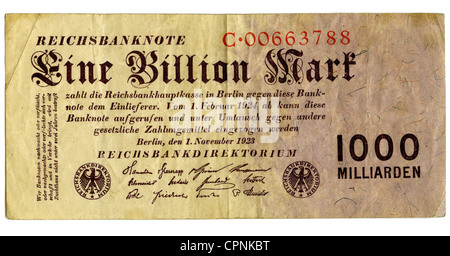

Payday loans give small amounts of money at the large rates of interest toward condition that it will feel reduced if the borrower gets the next paycheck. MoneyMutual, for example, advertises finance into the its web site in the rates of interest away from 261% to at least one,304%, Lawsky said.

Lawsky grabbed the business, and that promotes online pay day loans, in order to activity to own profit in order to This new Yorkers, in which such as for example loans try illegal.

Lawsky said MoneyMutual’s father or mother providers, SellingSource, put William’s profile so you can poorly force cash advance so you can The latest Yorkers. When looking to reassure individuals the loans was indeed secure, the firm would state, “Montel Williams provides recommended MoneyMutual and you may wouldn’t get it done in the event that they were not a legitimate business,” considering Lawsky.

Williams “is not blind on troubles of globe,” but “i stand-by his complete approval of cash Mutual,” Franks told you.

“When he states in public areas many times, Mr. Williams themselves put temporary financing when you find yourself attending the Naval Academy on the multiple event and you can repaid the individuals loans back for the day,” Franks told you.

MoneyMutual said from inside the an announcement the payment can assist they prevent “what could have been pricey and stretched litigation.”

In addition to the fine, that is paid over three years, the company features accessible to “modify the advertisements while making obvious you to definitely MoneyMutual’s features commonly accessible to customers of new York,” the firm told you.

MoneyMutual’s father or mother company SellingSource is owned by private equity business London area Bay Capital. Tuesday’s contract will not launch London Bay away from liability into the conduct uncovered within the Section out-of Monetary Services’ analysis, which stays ongoing, the latest regulator told you.

CFPB: Online pay day loans strike users with hidden exposure

People exactly who consider on the web lenders to possess payday loan face hidden dangers of high priced financial costs and you can membership closures, according to a national analysis put out Wednesday.

Half the brand new individuals just who got the fresh higher-attention finance online later was basically hit that have typically $185 for the financial penalties having overdraft and you can low-adequate money fees when the loan providers registered a minumum of one installment needs, the user Monetary Defense Agency investigation discovered.

One-third of one’s consumers who racked right up a bank punishment sooner or later confronted unconscious account closures, the fresh new report together with receive.

Online lenders produced regular debit effort with the borrowers’ membership, running up even more bank charge into the customers, as the operate usually don’t gather repayments, the research said.

“Each one of these a lot more effects away from an online financing is going to be extreme, and you can together with her they might impose high costs, both tangible and you will intangible, that go far above the fresh number repaid only to your brand spanking new lender,” told you CFPB Director Richard Cordray.

Obama pushes pay check credit guidelines when you look at the Alabama

The fresh results mark the consumer agency’s third study of You.S. payday credit industry that provides the brand new typically 300%-to-500%-interest-rates personal loans that numerous low-earnings borrowers rely on to invest costs payday loans cash advance for bad credit Blacksburg VA anywhere between that salary examine as well as the 2nd. The fresh new CFPB intentions to thing the fresh statutes to your loans afterwards this springtime, an effort supported by Federal government.

CFPB experts examined eighteen months of data regarding Automated Clearing Household. On the internet lenders commonly utilize the financial network to help you put financing proceeds towards borrowers’ checking accounts, and also to fill in further fees requests.

When the an excellent borrower’s balance is actually low when the on line financial sends a fees demand, the lending company is also come back the new request low-sufficient money or approve new request. In either case, the bank can charge the brand new debtor overdraft or low-enough money costs, in addition to late charge or returned fee costs.

The analysis investigation showed that new $185 inside the normal bank fees towards the pay day loan borrowers provided the typical $97 tacked towards the having a first ineffective debit demand. The new consumers as well as confronted the typical $50 charge when on the internet lenders made a second debit demand once a failed effort, and the common $39 cost when a loan provider recorded multiple payment needs towards same day.

Throughout, 23% away from profile held of the individuals whom got loans out-of on the internet lenders was more likely closed towards the end of 18-day sample months, the study discover. The results is much more than this new 6% probably closure speed to have bank accounts essentially, the newest declaration said.

A little half of most of the pay day loan lenders render finance and you can search repayments on line, the newest CFPB told you. Pay-day loan providers which do not render online mortgage services were not integrated regarding investigation.