Payday loans is actually perishing. Disease set? Nearly

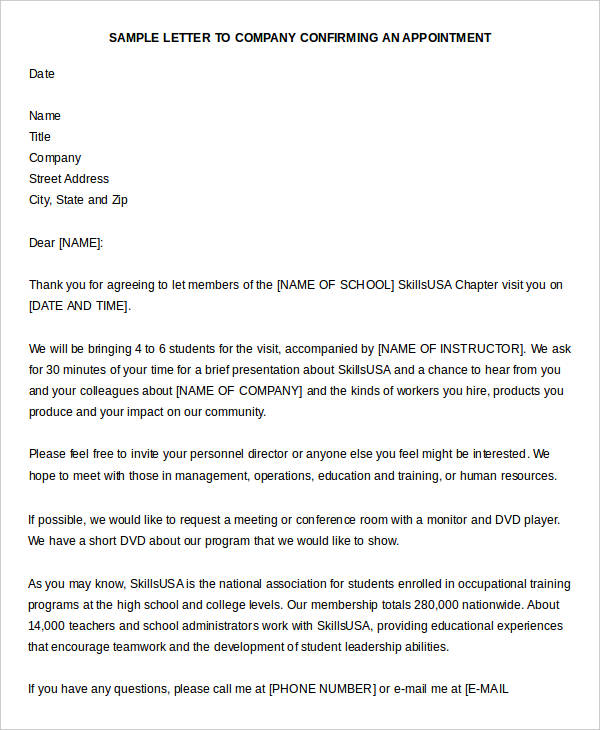

Pay check installment money was speedy and you can much easier while from inside the a beneficial pinch, but they’ve been still wii tip. (Photo: Getty Images/iStockphoto)

Penalties and fees and you may regulating scrutiny over high costs and misleading practices provides shuttered payday loans places nationwide during the last couples years, a development capped from the a suggestion past summer by Individual Financial Security Agency to help you maximum quick-term finance.

Individual shelling out for cash advance, each other store and online, features fell because of the a 3rd once the 2012 to help you $six.step one million, according to nonprofit Center getting Financial Services Invention. Tens of thousands of sites has finalized. When you look at the Missouri alone, there were around 173 a lot fewer active certificates for pay day lenders past season compared to the 2014.

Payday repayment money works like old-fashioned payday loans (that’s, you don’t have credit, just income and you can a checking account, which have money lead almost instantly), but they’ve been paid back in installment payments rather than you to lump sum. An average annual commission interest rate is generally down too, 268% against eight hundred%, CFPB research shows.

Fees fund are not the solution

Pay day fees money try fast and you will much easier if you’re inside an excellent pinch, however, they’re still not a good idea. Let me reveal as to why:

Speed trumps big date: Borrowers finish purchasing significantly more inside interest than they would with a smaller loan from the increased Annual percentage rate.

A one-seasons, $step 1,000 cost financing within 268% Annual percentage rate would sustain interest out-of $1,942. A payday loan on 400% ount manage cost from the $150 inside the costs if this was basically reduced in two days.

“While each and every fee could be sensible, whether it is true of a long time, the debtor may end right up paying off much more than what it borrowed,” said Eva Wolkowitz, director at the center to possess Financial Characteristics Invention.

You’re in the hole much longer: Pay day fees funds are organized so initial money shelter merely attract costs, perhaps not dominant.

“The latest offered the borrowed funds are, the more you happen to be merely repaying interest up front,” told you Jeff Zhou, co-inventor of Houston-created Fig Funds, a business that makes options to payday loan.

Add-ons add up: On top of highest interest rates, lenders can charge origination or other charges one push within the Annual percentage rate. Of numerous together with promote recommended borrowing insurance – maybe not within the Apr – that may fill the borrowed funds costs. Lenders field so it insurance rates in order to security the money you owe in the eventuality of unemployment, infection or passing. Although payout visits the financial institution, maybe not new borrower.

The fresh demand for pay day loan in virtually any function actually going away in the near future. 12 million Americans play with payday loan annually, normally to pay for expenses such as for example book, tools otherwise food, according to the Pew Charity Trusts.

“The initial a few-week loan originated customers’ demand for the merchandise. Likewise, people in many cases are demanding payment funds,” Charles Halloran,  head working administrator of one’s Community Financial Functions Organization out of The usa, a pay check lending exchange category, said inside the a message.

head working administrator of one’s Community Financial Functions Organization out of The usa, a pay check lending exchange category, said inside the a message.

Earnings growth are slow, expenses was up-and far more People in america are having irregular income, told you Lisa Servon, teacher out of area and you will local planning at University of Pennsylvania and you will writer of “This new Unbanking away from The usa.”

“It is the ultimate violent storm that’s very good with the high priced small-name financial institutions, less to the mediocre Western employee,” she said.

What’s the option?

When you are People in the us require brief-buck funds, 81% told you they had rather simply take a similar financing from a financial or a cards relationship at the straight down pricing, centered on latest Pew surveys.

Financial institutions is waiting for the new CFPB so you’re able to finalize its advised rule to possess pay day financing ahead of entering this market, considering Pew. Just like the destiny of one’s CFPB remains not sure in Trump management, banking institutions may well not bring cheaper pay day loan any time soon.

Meanwhile, if you like fast bucks, is a credit connection. Of several bring payday solution financing capped in the 28% Annual percentage rate so you can players. Nonprofit area communities including generate reduced- or no-desire funds to possess tools, book otherwise food.

NerdWallet is good U . s . Today articles companion delivering general reports, opinions and exposure from all over the net. Their content was introduced by themselves out of Usa Now.