Terrible borrowing details? You might pick a payday loan however, discover that it primary

Payday loans companies just be sure to share with people that have less than perfect credit ideas in the exorbitant charges.

Summarize

They’re limited inside the fifteen says in the usa, China enjoys topped the attention they could recharge and you may people teams when you look at the Europe was assaulting locate these folks banned. In Republic from india, payday cash seem to be prospering uncontrolled, with well over several loan providers using revealed properties in the past dos yrs.

A quick payday loan is largely a very quick-identity credit intended to assist the private wave more a short-term crunch. Think of it since your very own financing to own 7-30 day and age that has becoming paid in complete as well as fascination after you get the second earnings. Everything Rs 400 crore was disbursed by pay day loan providers month-to-month.

But these fund is generally prohibitively high priced, taking a pastime between 1percent and you will step one.5percent every single day. Into the an enthusiastic annualised basis, it do it to help you 365-540per cent. Bank cards, and this demand 2-3percent every month getting rollover (otherwise 24-36percent per annum) search inexpensive compared.

Brand new upside usually payday loan companies may possibly not be since the finicky as regular passage of property. They never mind sullied loans histories otherwise lower credit scores. In reality, it will help them charges high rates. Income men and women are usually subprime consumers and therefore anxiously need to have riches but have exhausted other options. Financial institutions wouldn’t let them has personal loans on 15-20% because of their bad installment record. They can’t withdraw employing credit card bills just as they have previously smack the restrict.

Acceleration of investing leads to funding. Payday advances you would like minimal forms and therefore are paid down immediately. a purchaser just requirements upload a good number of papers (Aadhaar, cooking pan cards, most recent paycheck slip and you may step three-week bank assertion) and provide an article-dated cheque into numbers payable to your end of the give. New article-dated cheque is the cover the lending company requires. If it bounces, the lender could be sued under the flexible equipment Work.

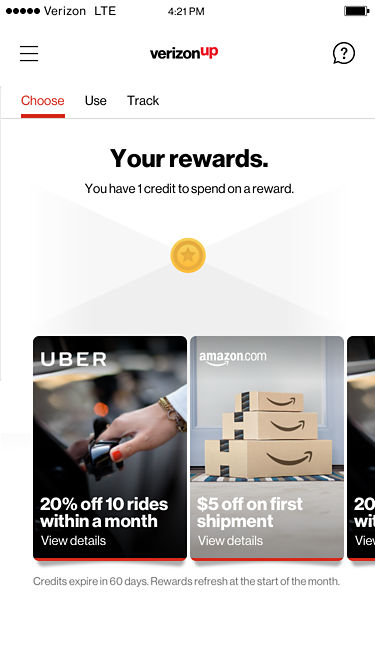

Pay day loan companies and you can chargesInterest out-of simply oneper cent every day do so so you’re able to 365% to your an enthusiastic annualised foundation. Supply: Providers websites

The genuine convenience of access to capital may seem for example a boon, however, pay day loans seldom correct this new downside educated since the of visitors. Predicated on Consumers capital cover company of Us management, more 80per penny off cash advance is collapsed over or followed by several other currency in this 14 days. You to considering a couple of users end up with at the very least 10 a lot more resource before these are typically debt-free. Sometimes, the customer simply digs themselves a bigger opening. Which is why pay day loans already blocked for almost all You records as they are according to the scanner at a distance. In Asia, limit appeal and that is energized towards payday cash was 36percent.

The brand new RBI should spot a hat how a number of a beneficial loan provider may charge. An appeal from only oneper penny everyday are awfully usurious, says Raj Khosla, Talking about movie director, MyMoneyMantra.

The best interest rate is not necessarily the only speed to have its buyer. There can be a running charge one to ount your use. If the cheque bounces if you don’t desire stretch the brand new payment big date, your slapped that have penal can cost you away from Rs five-hundred-step 1,100.

Payday loans or improve?The need for money now offers spawned an industry for quick-identity loans. As an alternative all of the loan providers request a bomb. EarlysalaryCEO and co-founder Akshay Mehrotra draws a positive change ranging from the solution and you can pay-day loan providers. We are not a payday loan people but a paycheck move forward team, according to him. The purpose might be improve customer manage their economic by giving the financing he’ll pay in about three-monthly instalments.

To own users, the key change could be the focus recharged. Earlysalary will get borrowing products all the way to 50percent on the wage and prices 2-dos.5percent per month. It is such as for example dealing payday loan fast Louisiana with more than their cc stability for some months. Earlysalary disburses currency well worth `150 crore monthly.

Are reasonable, actually pay day loan online employers usually are not only financing whales trying bring in people towards the a never-stop regime away from loans and you can borrowings. Several code debtors initially depending on the larger debts belonging to the costs they give to own. Loanwalle will set you back step one% each day out-of currency, but discourages returning people because of the climbing so you’re able to rates of the 1 bps whenever a debtor return for more. You need to promote cash advance payday loans just for problems. A crisis cannot checked times immediately after day. Any time you bring payday loans continually, right away you’ll focus on crack, states Abhijit Banerjee, movie director out of Loanwalle.